Managing Deposit Invoices with QuickBooks

Builder Prime lets you customize invoices and transfer data to QuickBooks. You can designate a deposit invoice to account for deposits, which can be seamlessly integrated with QuickBooks for both online and desktop versions.

Builder Prime allows for very flexible invoicing and also allows you to easily transfer your invoice data down to QuickBooks Online or QuickBooks Desktop. Many contractors take deposits or retainers for the work to be performed at some point in the future. When you do this, most accountants will probably tell you that those deposit invoices should get counted against a liability account until the services are rendered and/or products delivered.

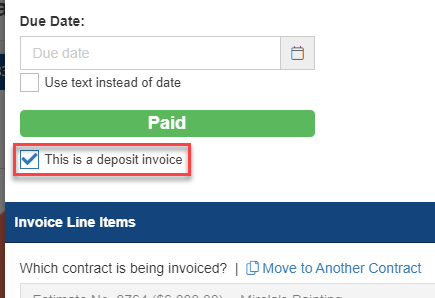

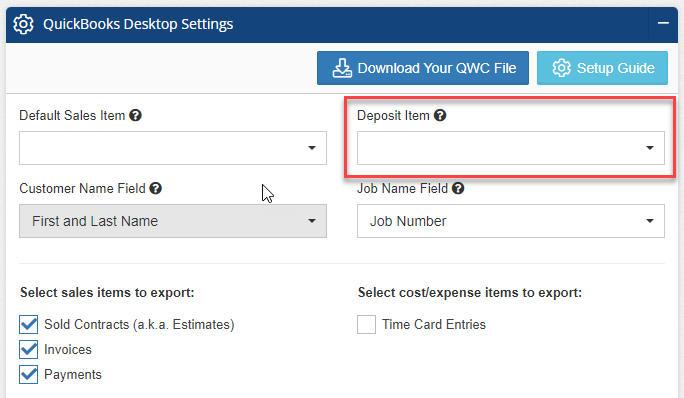

Builder Prime can send this data over to QuickBooks so you can easily conform to this requirement. All you need to do is simply designate one of the invoices on the project as a Deposit invoice. Then Builder Prime will send that invoice over against the Service Item attached to a liability account that you would specify in the QuickBooks Integration Settings. Note that this works with both QuickBooks Online AND QuickBooks Desktop.

The deposit invoice would indicate the amount against the liability account. The subsequent invoice(s) would enter a negative amount against the liability item and add the same amount to the receivables item.

Here is an article that talks about how this would work with QuickBooks Online: https://quickbooks.intuit.com/learn-support/en-us/help-article/service-items/record-retainer-deposit/L6B5RsY6l_US_en_US

Here is an article that talks about how this would work with QuickBooks Desktop: https://www.gentlefrog.com/how-to-enter-customer-deposits-in-quickbooks-desktop/

The QuickBooks integration is available starting with the Essentials plan. If you're interested in upgrading your current subscription, click HERE to learn how to upgrade your account.

-1.png?width=100&height=75&name=original-tar-ruler%20(1)-1.png)